Site

search Web search

Search this site or the

web powered by FreeFind

Better Business Bureau does nothing to resolve issue

Chronology of Court Case Against TD Ameritrade

Chronology of FINRA Arbitration Case Against TD Ameritrade

Click

here to add this page to your favorites folder!

Click

here to link to us.

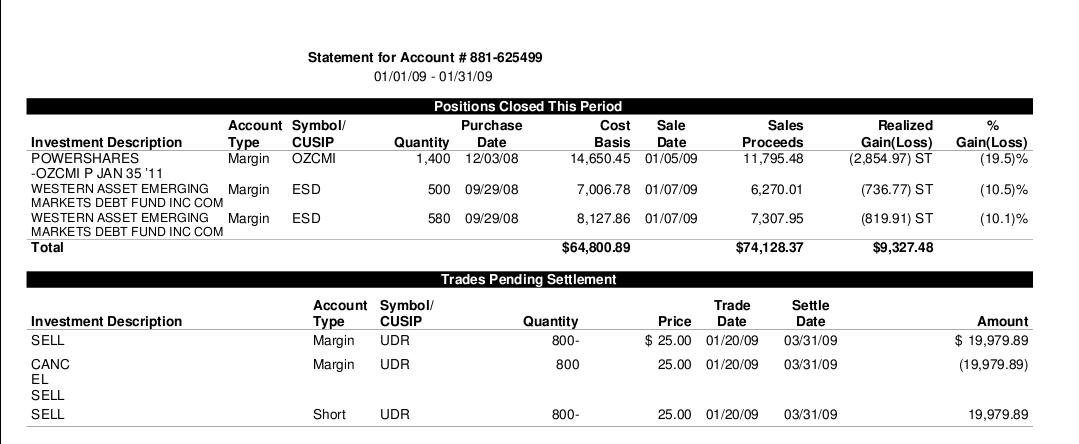

Laurent J. LaBrie v. TDAmeritrade

FINRA Claim 11-03725

Statement of Claim for Arbitration

PARTIES

1. Laurent J. La Brie, an INDIVIDUAL and non-professional investor, maintaining a PERSONAL self-directed brokerage account with TD Ameritrade (TDA) (Account #881-625499) from January 24, 2006, when Ameritrade Holding Corporation acquired TD Waterhouse (where La Brie had an account) until February 2009. The account was opened with Waterhouse Securities which was acquired by TD (Toronto Dominion) in 1996.

2. TD Ameritrade, broker-dealer with principal office at 4211 South 102nd Street, Omaha, NE 68127. Resident Agent: CSC-Lawyers Incorporating Service Company, 7 St. Paul Street, Suite 1660, Baltimore, MD 21202.

3. TD Ameritrade Clearing (TD Clearing) 4211 South 102nd Street, Omaha, NE 68127

4. Scott Cornett, Regulatory Compliance Department, TD Ameritrade, P.O. Box 2148, Omaha, NE 68103-2148

FACTUAL BACKGROUND

5. La Brie signed a brokerage agreement with TDA. TDA held all of the securities as custodian in book entry form.

6. The Margin Handbook (the “HANDBOOK”) constitutes a part of La Brie brokerage agreement with TDA. The Handbook provided by TDA states that they will "automatically exercise equity option contracts that are at least $0.01 in-the-money" and that customers must notify TDA if the customer desires otherwise. (See Statement of Claim Exhibit A Handbook, Page 15 Paragraph 1, highlighted)

"It is our firm’s policy to automatically exercise all long equity option contracts that are at least $0.01 in-the-money, and all long index option contracts that are at least $0.01 in-the-money. To exercise options outside of these parameters, or to decline the automatic exercise of options within these parameters, options owners must notify a Client Services representative of their instructions. This notification must occur by 4:30 p.m. ET on the last trading day for the option contracts."

7. On October 27, 2008, La Brie purchased 8 Put contracts of 100 shares of UDR, Inc., (NYSE stock symbol UDR) with a strike price of $25.00 and an exercise date of on or before January 16, 2009 (original option symbol UDRME, changed to UQWME in December 2008). The price of that contract was $9.50 per share. (See Statement of Claim Exhibit B.)

8. UDR, Inc. (UDR), formerly known as United Dominion Realty Trust, Inc., is a self administered real estate investment trust (REIT) that owns, acquires, renovates, develops and manages apartment communities nationwide.

9. The Handbook provided specifically that if, at the expiration date, the price of the stock was more than $0.01 below the exercise price of $25.00, and LaBrie had not earlier elected to "put" or trade the shares to the contract buyer, TDA would automatically execute the trade and sell the stock to the seller of the Put, and by its agreement with La Brie, create a "short" position between TDA and La Brie that La Brie would cover by purchasing the stock and returning it to TDA at a later time.

10. TDA had automatically performed this function for La Brie on many other occasions, including automatically exercising a September 2008 Put 999JNKUU4 on 9/22/08, which created a short position of SPDR High Yield bond fund (symbol: JNK).

11. TDA, in fact, executed the trade, and created a short position in La Brie’s investment account. TDA sent La Brie statements to confirm this action. The trade was assigned Transaction #04594471136 and CUSIP #902653104. (See Statement of Claim Exhibit C.)

12. The Account Activity section of the January statement (Statement of Claim Exhibit I) provided to Claimant contains an entry: "01/20/09 Margin Delivered - Other UDR INC - P JAN 25 EXERCISED"

13. The booklet "CHARACTERISTICS AND RISKS OF STANDARDIZED OPTIONS" provided to the Claimant by the Respondent states, "The option writer is obligated — if and when assigned an exercise — to perform according to the terms of the option." (Statement of Claim Exhibit J, Page 6) The booklet gives no exceptions, so those shares were sold to the option writer by someone and the money from the sale went to that person. In January, in multiple communications to the Claimant, the Respondent stated that that transaction was executed in the Claimant's account.

14. In order for an Options Principal to be Registered to practice, they must complete the Series 4 Training Course from The Securities Institute of America, Inc. The Series 4 manual states, "If an investor is not long the underlying stock and exercises a put option in a margin account, the required Reg. T deposit must be met by the payment date to hold the established short position." (See Statement of Claim Exhibit K.) Since my account held the required Reg. T deposit, my short position should have been established and held.

15. On January 16, 2009 the closing price of UDR was $12.42, well below the strike price of $25. The contract for which La Brie had paid $7915.95 for 8 Puts was now worth $10,064. On January 20, as La Brie had expected and had directed, TDA exercised the option. Unbeknownst to him, and undisclosed to him by TDA, because of a declared stock dividend, Claimant actually had the right to sell 108 shares per Put, so the real value of the option on January 16, 2009, was higher than $10,064.

16. The Transaction created a short position in La Brie’s account. To cover that short position, on March 17, 2009 at 09:39:01 La Brie bought 800 shares of UDR at $7.40. The transaction was assigned number 04769636054, and listed with CUSIP Number 902653104. (See Statement of Claim Exhibit D.)

17. In total then, the Claimant paid $7915.95 to buy the 8 Puts of 108 shares each. (A conversion from 100 to 108 shares per contract had occurred). La Brie gained the right to sell 864 shares of UDR at $25 per share which 864 shares La Brie had acquired in the open market for the price of $7.40. La Brie had made $18.60 per share. Multipled by 864, The Claimant's gross gain was $16,070.40. La Brie had paid $7,915.95 , including commission, for the option. The Claimant's profit would have been $8,154.45.

18. Previously, on December 5, 2008, La Brie noticed in his account holdings on the TDA website that the trading symbol for that option had changed to UQWME and that a quote was no longer available. Becoming concerned, Claimant called TDA to determine the reason.

19. La Brie spoke with the customer representative, Amanda, who consulted Scott Cornett in their options department. Scott Cornett said, "It looks like there was a symbol adjustment, that's why. Maybe a symbol change from UDRME to UQWME and under the new symbol it hasn't traded yet. There was no last trade." The customer representative relayed the message to La Brie "there's no volume on it and nobody's traded it and that's why it shows a zero dollar value." The communication was of a simple symbol change, otherwise all was still normal with this option and that quotes were not available because there was no trading volume for the options which is the case on any given day for most options issued This information was misleading.

20. The Respondent admits in Discovery item 12 that there it has no responsive documents where "current prices were not given for options with no trading volume." In fact, this is not TDA's practice.

21. In fact, this wasn't a simple symbol change. Rather, the OCC (Options Clearing Corporation, a federal regulated entity, registered with the Securities and Exchange Corporation and under the jurisdiction of the Commodities Futures Trading Commission), had in fact informed TDA Clearing by a Memo #25184 on December 2, 2008, that UDR was potentially changing a conversion ratio as a result of a special dividend, changing how quotations were given. On December 4, 2008, the OCC issued memorandum 25201 which informed members that "UDR/LDH CALL OPTION HOLDERS HOW DO NOT WISH TO RECEIVE ONLY THE STOCK PORTION OF THE NON-ELECTING DIVIDEND CONSIDERATION MUST EXERCISE THEIR OPTIONS IN ADVANCE OF THE CONTRACT ADJUSTMENT AND MAKE THEIR OWN ELECTIONS" (emphasis theirs). On January 13, the OCC issued memorandum 25358 to its members, which included the Respondents, to contact their customers and advise that because of the conversion change, the customers must manually elect their options or puts. (See Exhibits F & G.) The change in conversion ratio was subsequently determined to be approximately 108:100, meaning La Brie could sell 108 shares per contract, making those contracts 8% more valuable to La Brie. The statement that the option had simply changed symbols was misleading. TDA did not advise the Claimant of the favorable events regarding Claimant's position in this Put contract. It did not do as directed by the OCC, that is advise its customers that they would need to make a manual election. No statement or notice of any change in law, regulation or governmental policy was given to La Brie. Respondents gave La Brie no notice of the changed symbol or any explanation for it, other than its being listed in place of the former symbol on the website and monthly statements.

22. Respondents did not consult the OCC website for information on the option. In its response of 11/23/11 the Respondents state, that "it would be literally impossible" for them to ensure that its option holders are informed of all OCC "Infomemos". This, itself is misleading, since the Claimant called the Respondent after the memorandum was issued and a member of an "options team" should be familiar with the search function on the top of the homepage of the OCC website and within 5 seconds could find a memo when a customer calls as Claimant did on December 5, 2008. Moreover, the OCC memorandums are directives binding on its members, which include the Respondents, but not the Claimant.

23. In discovery, Respondent was asked for

- "9. any policy or other written directive to TDA's employees/brokers during the period of October 27, 2007 to January 16, 2010 stating the instructions to brokers regarding an "in the money" option transaction, notification of clients about options issues and pending expirations, as well as those specifically regarding the UDR options ( Paras. 5) (a), 9), and 11)),"

- and "10. any policy or other written directive to TDA's employees/brokers in force during the period of October 27, 2007 to January 16, 2010 stating what research should be done and what information should be given a client when he/she calls regarding changes to the symbol for an option as well as those policy or directive specifically regarding the UDR options ( Paras. 5) (a), 9), and 11)),"

Respondent replied that it had none because "accounts at TD Ameritrade are self-directed."

Claimant states in their ANSWER OF RESPONDENT TD AMERITRADE TO STAEMENT (sic) OF CLAIM "Claimant had a self-directed brokerage account and responsible (sic) for knowing about events which may affect securities in his account." Yet, on Page 3 of the Account Handbook provided by Respondent in its discovery packet states:

"Contact a Client Services representative for questions about your order status, your account, trades, balances, safekeeping or reorganization issues, and certificate requests."

If the Respondent is suggesting that customers call if they have questions, it should make some effort to answer those questions correctly. Otherwise, Respondent is not assisting its employees to avoid violation of FINRA Rules prohibiting "Misrepresenting or failing to disclose material facts concerning an investment." It should have policies in place to guide its employees how to find said material facts. The Respondent admitted that it has no such policies and demonstrates failure to supervise and train its employees.

24. On January 16, 2009, the OCC issued Memo #25370 advising their members, among them, TDA Clearing (See Exhibit A, page 11, highlighted), that nothing had changed with regards to the dividend subsequent to Memo #25184. (See Statement of Claim Exhibit H.) Memo #25370 directed Respondent to advise Respondent's clients that, because there were no further developments, the OCC had disabled the automatic exercising of these contracts. The OCC instructed TDA Clearing, among others, that TDA Clearing "SHOULD ADVISE THEIR CUSTOMERS TO TAKE THE FOLLOWING CONSIDERATIONS INTO ACCOUNT IN DECIDING TO EXERCISE, OR NOT TO EXERCISE, THESE OPTIONS." (Emphasis is the OCC's.).

25. The OCC however, did not require TDA to violate any existing agreement with customers; the OCC merely stated that clients should be advised.

26. FINRA rules prohibit brokers from,

"Misrepresenting or failing to disclose material facts concerning an investment. Examples of information that may be considered material and that should be accurately presented to investors include the risks of investing in a particular security; the charges or fees involved; company financial information; and technical or analytical information, such as bond ratings."

27. There is no doubt that the information on the OCC Memorandums facts were "material" since the OCC had disabled automatic execution of the options because of them.

28. TDA violated the direction of the OCC by not immediately advising LaBrie of the Memo, which would have enabled LaBrie to exercise the Put contract regardless of the fact the Brokerage Agreement already obligated TDA to exercise the Put and TDA did, in fact, exercise the Put.

29. TDA has reversed the trade and removed monies from La Brie’s investment account. TDA alleges it executed the trade in book form only. TDA alleges it did not execute the trade because it could not reach La Brie. The Discovery document from Respondent entitled Salesforce Call Notes.pdf, page 6 includes an entry on 1/16/2009 , an outbound call to an undocumented phone number "OBC, line busy. ...Unable to reach client." These allegations are false. Both telephone numbers in the logs for the Claimant have voicemail and thus never give busy signals.

30. As stated above, unbeknown to him at the time but later discovered, TDA had manually exercised the options after automatic exercising of these options had been disabled. The fact that this trade was done deliberately and manually by a TDA employee shows that the Claimant had made clear that the Claimant desired such exercising, which indeed La Brie had on December 5th.

31. TDA made another error when they logged the Claimant's sale to his margin account where there were no shares to sell. They noticed this error some time later, reversing the sale and making the position a short. Thus, the Confirmation Notice contains the phrase "CORRECT PREVIOUS CONFIRM ACCOUNT TYPE...YOU SOLD SHORT" (emphasis theirs). This is also evidenced by the Claimant's Statement of January 2009 (Statement of Claim Exhibit I) where it reads:

32. On March 28, two months after the option was exercised and even after La Brie had bought the stock to cover La Brie's position, Claimant was told by a TDA manager that the two profitable trades of January 20 and March 17 were going to be reversed against La Brie's wishes and obviously against La Brie's best interests. La Brie strenuously objected to this arbitrary and unlawful TDA action.

33. The removal of these funds without Claimant's authorization violated FINRA's rule against "Removing funds or securities from an investor's account without the investor's prior authorization."

34. Removal of the funds after the Claimant made it clear to TDA that the funds were under controversy also violated the arbitration clause in the Agreement signed by both the Claimant and Respondents. This clause states, "All controversies concerning ... any transaction ... which may arise between TD AMERITRADE or Ameritrade Clearing, or their representatives and me shall be determined by arbitration in accordance with the rules of the National Association of Securities Dealers, Inc." When Respondent knew that the Claimant objected to the removal of these funds, the resolution procedure that the parties had agreed upon was to bring the case to arbitration, which Respondent failed to do.

35. In short, the facts are:

- The agreement between Claimant and TDA is that all options in the money by more than 1 cent should be exercised.

- The OCC, on December 2, had informed the Respondent in Memo #25184:

"The Options Clearing Corporation ("OCC") has been informed that UDR, Inc. ("UDR") has announced a Special Dividend valued at $0.97. UDR Stockholders will have the ability to elect to receive the special dividend in the form of cash or additional UDR shares. The consideration which will accrue to non-electing UDR Shareholders is not known at this time. The cash or stock election must be received prior to 5:00 p.m. (EDT) on January 20, 2009." (See Enclosure F) - An "options team" should know that a dividend in the form of UDR shares would be affect the value of options differently than would a cash dividend and make it impossible to price the shares. On December 5, Claimant was told by the TDA "options expert" that this option was normal and therefore pursuant to the Agreement, TDA would exercise them normally. Respondent withheld this information and misled Claimant with this misinformation and, in doing so, violated FINRA rules and breached Respondents' contract with Claimant.

- Claimant received confirmation that the option was exercised.

- Claimant had multiple confirmations from TDA that the short of UDR was executed twice, once erroneously in La Brie's margin account (which was reversed on the same day) and once correctly in La Brie's short account. Contrary to TDA's assertions, never was there any question that the sale itself was erroneous and never did this appear as a “book entry” or any differently than any other short Claimant has held in his account. OCC Memo #25468 dated February 12, 2009, during the period Claimant held the shorts, in fact states that, due to the dividend, each contract should have been 108 shares, instead of 100. This means that Claimant's gains should have been 8% greater than what was ever credited to Claimant by TDA.

- Claimant has multiple confirmations from TDA that Claimant's cover of the short was executed.

- Over the two month period, Claimant logged into his account dozens of times to check the progress of this matter. Other than the symbol change, which TDA explained as normal, never was there any indication that the trades made were any different than the many others Claimant had made with TDA.

- Claimant received and accepted confirmations for two months in Claimant's monthly statements.

- To the extent TDA made an administrative error and did not execute the trade, in contradiction of its agreement with La Brie, TDA should suffer the loss from this action.

- Removing these funds without Claimant's authorization violated FINRA rules and the Respondent's Customer Agreement with the Claimant.

36. Until TDA reversed all Claimant's properly requested and executed trades, TDA proceeded under their Agreement and under Claimant's direction. As is evidenced by documents provided by TDA, TDA exercised the option as La Brie requested. TDA shorted the stock as is required by exercising a Put option that La Brie purchased through TDA. TDA covered the short as La Brie requested. La Brie bought the stock to cover the position. This all resulted in a gain for which La Brie took the sole risk and rightly earned and which now TDA has misappropriated.

37. Clearly, since TDA recognizes that all the trades did, in fact, occur, they have profited from Claimant's risk (which in the case of shorting stocks is unlimited) and Claimant's investment of $7,915.95 and unjustly retained the reward of $15,173.94 with the inclusion of the 8% dividend owed La Brie. Thus, the gains of $15,173.94 are rightfully the Claimant's and should not have been transferred from Claimant's account.

WHEREFORE, pray the Arbitrator award compensatory damages in the amount of $15,173.94 investment losses plus attorneys fees and costs of $6,371.52, plus 1% interest and such other and further relief as is just and proper.

Exhibit

A List of OCC members.

Better Business Bureau does nothing to resolve issue

Chronology of Court Case Against TD Ameritrade

Chronology of FINRA Arbitration Case Against TD Ameritrade

© 2009-2014